The CAPM equation suggests that the higher the beta, the higher the expected This is a regression that allows us to estimate

In this regression, the beta is the ratio of the covariance to the variance of the market return. Log likelihood 997.551 Hannan-Quinn criter. Sum squared resid 0.014 Schwarz criterion -7. of regression 0.007 Akaike info criterion -7. Error t-Statistic Prob.Īdjusted R-squared -0.003 S.D. Included observations: 281 after adjustments the volatility of the asset i compared to the market portfolio M, (2) E (Rm) is the expected return on the market portfolio Rf is the risk-free rate βi is a measure of risk for security i. (E (Rm) - Rf) (1) Where: E (Ri) is the expected return on security i In risk premium form CAPM equation can be written as: E = βi. Research methodology The study starts analysis by empirical model developed by Sharpe (1964) and Lintner (1965) in which a relationship for expected return is written as: E (Ri) = Rf + βi. The UK Market Index has been used as a proxy. The number of observations for each company is 240.

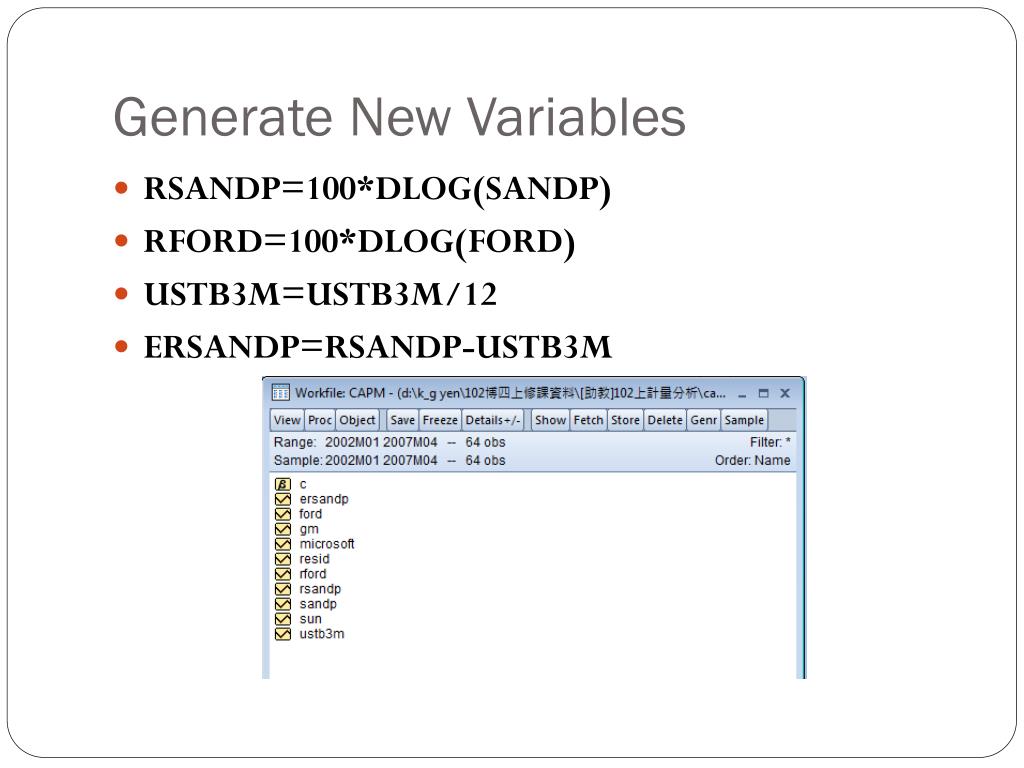

CAPM EVIEWS SERIES

Series of monthly data were used for the econometric analysis. The research on the CAPM model was conducted on a sample of 280 companies listed on the UK Stock Exchange. Data selection The case study applies the CAPM model on the UK Stock Exchange data with the aim of interpreting and considering the utility of the estimations of the model. Fama and French have argued that beta cannot be considered anymore a true measure of risk and that some empirical evidence has proved that the slope of equation used in CAPM is negative. Notably, Fama and MacBeth (1973) supported the model they examined whether there is a positive linear relation between average returns and beta, Fama and French (1993) rejected the model. In the following period, many studies have supported this approach, but also some other criticized the mode. Although the CAPM has been predominant in empirical work over the past 30 yearsġ GFCF 4- and is the basis of modern portfolio theory, an enormous research effort has been devoted to the empirical testing of the model over the past several decades. There are plenty of tests on the validity of the Capital Asset Pricing Model (CAPM) in the literature. The CAPM predicts that the expected return on an asset above the risk-free rate is linearly related to the non-diversifiable risk, which is measured by the asset’s beta. The Capital Asset Pricing Model (CAPM) of Sharpe (1964) and Lintner (1965) is based on the idea that not all the risks influence the prices of the assets and that a risk can be diversified and reduced in a portfolio. JEL codes: G Theoretical background The way the risk of an investment affects the expected return has been a fundamental issue in finance.

CAPM EVIEWS FREE

Key words: Capital Asset Pricing Model (CAPM), beta, risk free rate, risk premium, expected return

Theįindings of this article do not necessarily provide evidence against CAPM. The intercept is statistically significant, upholding theory, for both individual assets and portfolios. The empirical test on CAPM follows the methodology pioneered by Fama and MacBeth (1973) the results confirm that It should be emphasized that this paper is merely intended to test CAPM model’s three implications for individual securities and for prtfolios. To explain variation in expected returns across assets and over time, to find if there is a linear relationshipīetween expected return and risk, if beta is a complete measure of the risk and if a higher risk is rewarded by a higher expected return. Our intention is to examine the model's ability Interpretation of results and relevance of the model estimates. Listed on UK Stock Exchange, for monthly intervals between January 1986 and December 2005, following the This paper re-examines the tests of the Sharpe–Lintner Capital Asset Pricing Model (CAPM) for the UKĬompanies, both for individual stock and for portfolios, using a sample of monthly data for 280 companies

0 kommentar(er)

0 kommentar(er)